1. Hindsight is 20/20. And Not Even Then.

We don’t know the terms Jason offered for his $25,000 and I won’t speculate. What I do know is that for some reason (arrogance, optimism, stupidity, fear, all of the above), Cele & the team were convinced that not taking $25,000 from Jason was a good idea. Before we rush out and say, “you SHOULD have taken that money because you could have died!”, remember that life is littered with people who were about to take one deal when a better one was around the corner.

It’s in Jason’s interest to make it look like Tiketmobile would have thrived under his tutelage but we don’t know that. They could have got a better deal a week later (not likely) but they didn’t. Tough.

Again, hindsight is 20/20. It is in this same world that Google offered Groupon $6bn. Also in this same cold, cold world that Yahoo offered $1bn for Facebook.

2. That being said, founders need to get realistic. About everything.

No seriously. Get realistic about the amount of funding there is out there (not much), your startup’s chances (slim to none), the greatness of your idea (meh) but most importantly… your fundability.

You need to realize that big funders (PEs, VCs etc) operate with companies that have achieved a particular scale and have founders (emphasis on S) with particular characteristics. They call it pattern-matching. If you’re just out of UNILAG doing NYSC with a small startup, you don’t fit the pattern. So when that “arrogant” beast comes with his $25,000, you should sit up, listen and take a hard look at your options.

3. Know. What. Your. Business. Is.

In my opinion, there are two types of tech startups – tech wonders & operational wonders. Things like Facebook, Twitter and Evernote are basically tech wonders. They are all about the technology, fundamentally. For the longest time, their most precious resource is engineers and their services can be used across borders without local teams being involved.

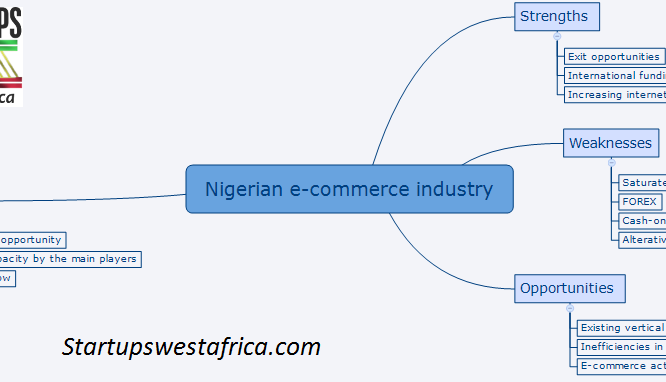

Then there are operational wonders – these basically use the internet to disrupt a traditional market/industry. It’s easy to point these out because that’s what Rocket focuses on. They refer to them as “internet businesses” for a reason. In those businesses, the tech isn’t the most important part of the product. Success is often determined by marketing, operations, customer experience etc. So think e-commerce, deals, hotel reservations, movie distribution etc. The fact is that most of the internet businesses founded today fall into this category.

The mistake a lot of “techies” keep making is that they think that they should building tech wonders when they should be building operational wonders. You’re selling bus tickets and you think (somehow) that your app is the most important part of your product. No one gives a crap! They just don’t want to have to report to the bus park JUST TO BUY A TICKET. You should be working on sales, distribution and the customer experience first. It’s a mistake I’ve made but it’s not one to keep making.

4. There’s a School of Thought That Says That Funding Isn’t Important. Bullshit.

ESPECIALLY IF YOU’RE RUNNING AN INTERNET BUSINESS THAT CAN BE REPLICATED IN THE NEXT MORNING BY SOMEONE WITH BETTER FUNDING. No seriously. If there’s anything we can all learn from Jason’s post, it’s that.

5. Life is Short, But It’s Also Long

If you’re going to spend 5 years of your life working on something, you shouldn’t really mess around about it. You should take each day seriously. So if you’re “doing a startup” while keeping your life in a holding pattern, you should stop and ask yourself what you want.

But life is long, and this is probably not going to be your last shot. You should understand that it’s ok to build a company and have a minority stake today if it sets you up for a better shot in the near future. If you’re not foreign-educated, from a wealthy and/or with a lot of connections, you’re going to need to work your way up. That may mean having a successful company on your CV even if you had a less than ideal shareholding. The great thing about success is that it often breeds more success.

To be truly honest, some of the people holding on the founder’s flag may be better suited to be employees of some sort today. So if you have the opportunity to learn how to build a business and still have equity, it may be a shot worth taking.

So tell me, what else have you learnt from this “fiasco”?

This post first appeared on Seyi’s blog.